Turning Your Bonus Into a Wealth Multiplier

The notification arrives — “Bonus credited.”

For many salaried professionals, that moment brings excitement, relief, and a little temptation.

Maybe it’s your annual bonus.

Maybe a performance incentive.

Or even a festive Diwali bonus that feels like a financial reward for a year of hard work.

And then comes the big question:

Should you spend it, save it, or invest it?

Most people treat bonuses as “extra money.” But financially smart individuals treat them differently — as accelerators of wealth.

A well-used bonus can:

- Speed up financial independence

- Build long-term investments

- Create passive income streams

- Strengthen financial security

If used wisely, even one bonus a year can compound into life-changing wealth over time.

This guide explores practical, real-world stock market investing ideas for workers with bonuses — designed for Indian and global salaried professionals who want to make smarter money decisions.

Why Bonuses Are Powerful Wealth-Building Opportunities

Bonuses are unique because they are non-essential income.

Unlike your monthly salary, bonuses:

- Are not required for routine expenses

- Offer flexibility in allocation

- Provide lump sum investing opportunities

- Enable faster compounding

The Hidden Power of Bonus Investing

When invested instead of spent, bonuses act like:

- Annual wealth boosters

- Compounding accelerators

- Risk-tolerant capital

Even investing 50% of your bonus every year can significantly outperform regular investing alone.

Mini Summary:

Bonuses are powerful because they allow lump sum investments without disrupting monthly cash flow.

Smart Ways to Allocate Your Bonus Money

Before jumping into the stock market, define your allocation strategy.

A simple framework:

- 30–50% Investing

- 20–30% Savings or emergency fund

- 10–20% Debt repayment

- 10–20% Lifestyle or experiences

Quick Rule: The 50% Wealth Formula

Invest at least half your bonus to build long-term financial strength.

Mini Summary:

Allocation matters more than the amount. A structured split prevents regret and impulsive spending.

Short-Term vs Long-Term Investment Strategy

Your bonus investment style should depend on your goals.

Short-Term Strategy (1–3 Years)

Best for:

- Planned purchases

- Business capital

- Travel funds

Focus on:

- Low-volatility investments

- Hybrid funds

- Defensive stocks

Long-Term Strategy (5–15 Years)

Best for:

- Retirement planning

- Wealth creation

- Child education

Focus on:

- Equity-heavy portfolios

- Index funds

- High-quality stocks

Mini Summary:

Short-term = capital safety. Long-term = growth and compounding.

Risk-Based Investment Allocation (Low, Medium, High Risk)

Not every investor has the same risk appetite.

Low Risk Investors

Ideal for conservative earners.

Options:

- Large-cap index funds

- Blue-chip stocks

- Dividend-paying companies

Medium Risk Investors

Balanced wealth creators.

Options:

- Flexi-cap funds

- High-quality midcaps

- Sector leaders

High Risk Investors

Aggressive growth seekers.

Options:

- Small-cap stocks

- Sectoral themes

- Tactical investing

Mini Summary:

Match risk with time horizon. Longer horizons can handle higher equity exposure.

Tax-Efficient Bonus Investing Tips

Bonuses are often heavily taxed, especially in countries like India.

Here’s how to invest tax-smart:

- Use tax-saving equity instruments (like ELSS equivalents in your country)

- Harvest losses strategically

- Use long-term capital gains benefits

- Avoid frequent trading

Indian Context Tip

If your bonus pushes you into a higher tax bracket, prioritize tax-efficient equity investing instead of idle savings.

Mini Summary:

Tax efficiency boosts real returns — what you keep matters more than what you earn.

Common Mistakes People Make With Bonuses

Many professionals unknowingly waste the financial potential of bonuses.

Mistake #1: Treating Bonus as “Free Money”

This leads to impulsive spending and zero wealth creation.

Mistake #2: Timing the Market Perfectly

Waiting endlessly for the “perfect dip” often leads to missed opportunities.

Mistake #3: Over-Diversification

Too many small investments reduce meaningful compounding.

Mistake #4: Ignoring Taxes

High churn leads to unnecessary tax leakage.

Mini Summary:

Discipline beats timing. Consistency beats complexity.

Psychological Tips to Avoid Lifestyle Inflation

Bonuses often trigger emotional spending.

The Lifestyle Trap

A bigger bonus leads to:

- Bigger gadgets

- Expensive vacations

- Unnecessary upgrades

Instead, build psychological safeguards:

- Wait 7 days before spending

- Invest first, spend later

- Automate investments

- Celebrate within limits

Mindset Shift:

Bonuses are not rewards — they are financial leverage.

Mini Summary:

Control emotions, and your bonus becomes a wealth tool instead of a spending trigger.

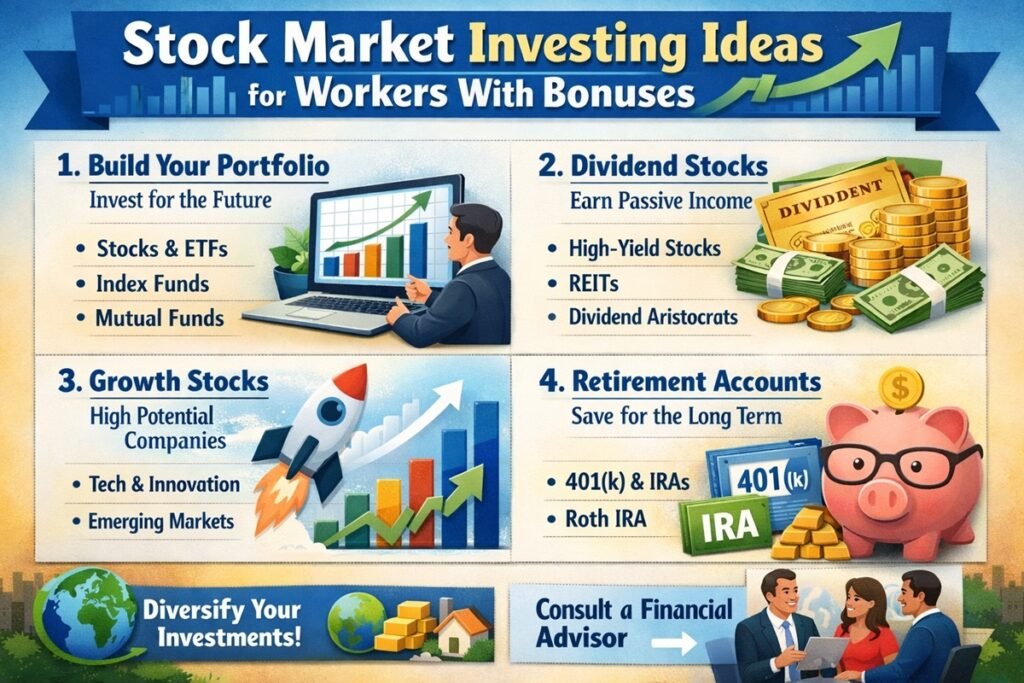

Best Stock Market Investing Ideas for Workers With Bonuses

This is where strategy meets execution.

Here are practical, proven investing ideas that work well with bonus money.

1. Index Funds: Simple, Scalable Wealth Builders

Best for beginners and busy professionals.

Why they work:

- Low cost

- Market-linked returns

- Minimal monitoring

- Strong long-term performance

Great for lump sum deployment with long horizons.

2. Blue-Chip Stocks: Stability With Growth

Large, well-established companies offer:

- Strong balance sheets

- Predictable growth

- Lower volatility

- Long-term compounding

Ideal for conservative bonus investors.

3. Dividend Stocks: Passive Income Angle

Perfect for those who value:

- Cash flow generation

- Defensive investing

- Retirement planning

Reinvest dividends to accelerate compounding.

4. Lump Sum vs SIP Investing

What is Lump Sum Investing?

Investing a large amount at once into the market.

Best for:

- Market corrections

- Long-term horizons

- Valuation-conscious investors

What is SIP (Systematic Investment Plan)?

Investing smaller amounts periodically.

Best for:

- Risk smoothing

- Market volatility

- Behavioral discipline

Hybrid Approach:

Deploy 50% lump sum, 50% via SIP over 6–12 months.

5. Sectoral Opportunities

Bonuses allow tactical bets on high-growth sectors.

Examples:

- Technology and AI

- Financial services

- Energy transition

- Healthcare innovation

Use limited allocation to avoid concentration risk.

6. Hybrid Strategies

Combine multiple approaches:

- Core: Index funds (60%)

- Stability: Blue chips (20%)

- Growth: Midcaps or sectors (20%)

This creates balance between stability and upside potential.

Quick Action Plan

If you just received a bonus:

- Step 1: Allocate 50% to investments

- Step 2: Put majority into index funds

- Step 3: Add 2–3 quality stocks

- Step 4: Use SIP for phased deployment

Mini Summary:

Balanced strategies outperform aggressive bets for most salaried investors.

Future of Investing for Salaried Professionals

The investing landscape is evolving rapidly.

Trends shaping the future:

- AI-driven investing tools

- Global investing access

- Fractional ownership models

- Passive investing dominance

For salaried workers, this means:

- Easier diversification

- Lower fees

- More transparency

- Smarter decision tools

The biggest edge?

Starting early and staying consistent.

People Also Ask (Quick Answers)

Should I invest my bonus as lump sum or SIP?

If markets are fairly valued and your horizon is long, lump sum works well. If unsure about timing, split your bonus — invest part immediately and stagger the rest via SIP over 6–12 months.

Is it safe to invest a bonus in stocks?

Stocks carry volatility but offer superior long-term growth. Safety depends on diversification, time horizon, and quality of investments. For horizons beyond 5 years, equity investing is generally considered wealth-building.

How much of my bonus should I invest?

A common rule is investing 30–50% of your bonus. If you already have emergency savings and low debt, you can invest even higher proportions for accelerated wealth creation.

Are mutual funds better than direct stocks?

Mutual funds offer diversification and professional management, making them ideal for most investors. Direct stocks can deliver higher returns but require research, monitoring, and emotional discipline.

What are the best tax-saving investments for bonus money?

Tax-efficient equity options like ELSS-type instruments (in India) or long-term equity funds can reduce tax liability while building wealth. Always consider your tax bracket before allocating.

Should I clear debt or invest my bonus?

If you have high-interest debt (like credit cards), repay it first. If your debt has low interest (like home loans), you may consider a balanced approach between investing and repayment.

Is bonus investing suitable for beginners?

Yes. Bonuses are ideal for beginners because they allow lump sum investing without affecting monthly budgets. Starting with index funds or diversified mutual funds is a beginner-friendly approach.

Can bonus investing help early retirement?

Absolutely. Consistently investing annual bonuses significantly boosts compounding. Over 10–15 years, bonus-driven investing can meaningfully accelerate financial independence timelines.

Should I invest bonuses during market highs?

Instead of trying to time highs or lows, focus on long-term allocation. If valuations seem high, stagger investments using SIPs to reduce timing risk.

What’s the biggest mistake people make with bonuses?

The most common mistake is spending the entire bonus impulsively. Without intentional allocation, bonuses disappear quickly and fail to contribute to long-term financial growth.

Conclusion: Build Wealth With Intent, Not Impulse

A bonus is more than extra income.

It’s a financial opportunity disguised as a reward.

Used wisely, it can:

- Accelerate wealth creation

- Strengthen financial confidence

- Build long-term security

- Move you closer to financial freedom

The key isn’t chasing returns.

It’s building habits.

Invest consistently.

Allocate thoughtfully.

Think long-term.

Your future wealth won’t be built by one big decision — but by many small, disciplined ones.

And if there’s one habit that separates financially confident professionals from the rest, it’s this:

They invest their bonuses instead of spending them.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always consult a qualified financial advisor before making investment decisions.

Feel free to Write for Us about Finance and Follow Us on: Twitter, Facebook, Instagram, Threads, and Whatsapp Group.