The Motilal Oswal Nifty MidSmall Financial Services Index Fund is a sector-specific, passive mutual fund launched by Motilal Oswal Mutual Fund with the objective of tracking the Nifty MidSmall Financial Services Total Return Index.

As an index fund, it does not rely on active stock picking but seeks to replicate the performance of its benchmark index with minimal tracking error and systematic exposure to mid and small-cap financial services companies.

Nifty MidSmall Financial Services Index Fund Overview – Understanding the Basics

- Investment Objective: To provide returns that, net of expenses, closely correspond to the total returns of the securities in the Nifty MidSmall Financial Services TRI.

- Benchmark: Nifty MidSmall Financial Services Total Return Index.

- Launch/Inception Date: 19 November 2024.

- Fund Managers:

- Swapnil P. Mayekar (Equity)

- Dishant Mehta (Associate)

- Rakesh Shetty (Debt oversight)

Investment Minimums

- Lumpsum & SIP Start: ₹500 with subsequent increments of ₹1.

- Exit Load: 1% if redeemed within 15 days of allotment; no exit load after 15 days.

Expense Ratio

- Direct Plan: Approx. 0.63%

- Regular Plan: Approx. 1.13%

These parameters make it accessible to retail investors and systematic investors looking for a low-cost, rule-based exposure to the financial services sector.

Benchmark Index Explained

The Nifty MidSmall Financial Services TRI consists of mid and small-cap financial services companies listed on Indian stock exchanges. Unlike broader market indices that include large caps, this index focuses on smaller, high-growth firms within finance — such as digital finance platforms, niche lenders, and emerging payment processors.

This concentrated thematic exposure differentiates it from traditional broad indices (e.g., Nifty 50 or Nifty Financial Services), targeting dynamic segments of the financial sector that may outperform during certain economic cycles, albeit with greater volatility.

Portfolio Composition & Sector Exposure

Based on recent portfolio reports:

Asset Allocation (as of Late 2025)

- Equity: ~99.2%

- Debt & Others: ~0.8%

- Cash/Reverse Repo: Minimal exposure.

Market Cap Segmentation

- Mid Cap: ~83.4%

- Small Cap: ~13.0%

- Large Cap: ~2.7% (minimal residual firms in the index).

Top Holdings (Representative)

- BSE Ltd. ~11.0%

- The Federal Bank Ltd. ~5.9%

- PB Fintech Ltd. (Policybazaar) ~5.7%

- IndusInd Bank Ltd. ~5.3%

- HDFC Asset Management Company Ltd. ~4–5%

This diversified array supports broad capture of financial sector growth beyond traditional banking giants.

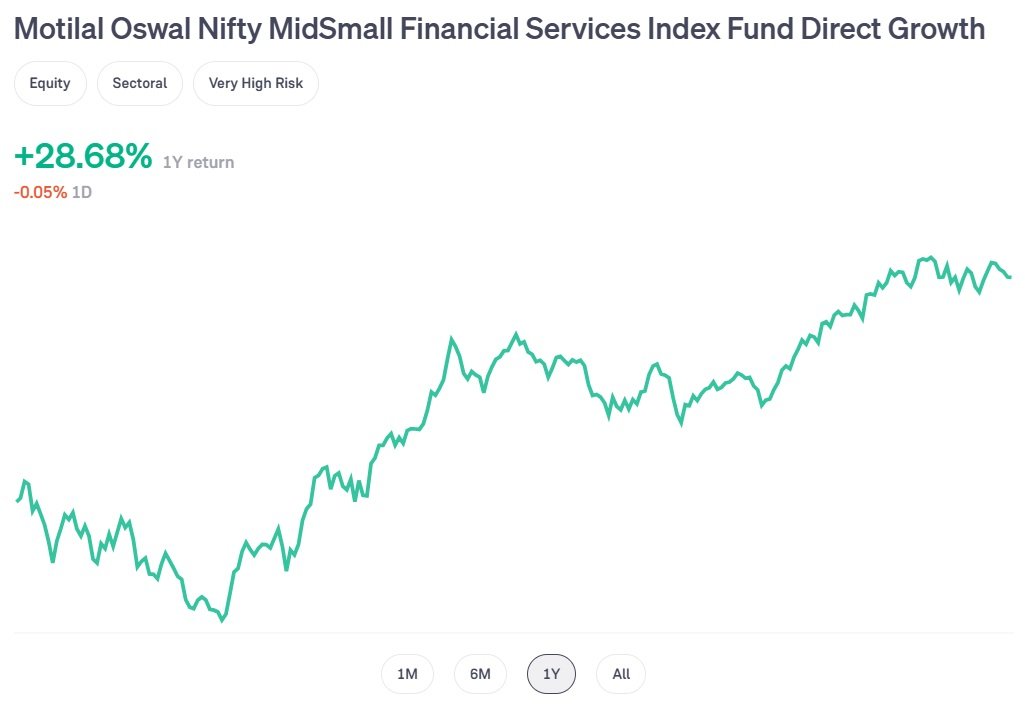

Performance Overview – Returns & NAV Trends

NAV & Growth

- As of December 2025, the NAV of the Direct-Growth plan is approximately ₹13.36–₹13.39 (indicative).

Trailing Returns

According to third-party data as of late 2025:

| Period | Fund Returns | Category Average |

| 1 Month | ~-2.0% | ~-1.95% |

| 3 Months | ~+13.7% | ~+2.97% |

| 6 Months | ~+6.7% | ~-1.54% |

| 1 Year | ~+28.4% | ~+1.7% |

The fund has delivered notable growth since launch, with annualized returns exceeding many peers and outperforming average category returns. Its higher returns reflect the mid-small cap segment’s sensitivity to Indian economic growth and credit expansion.

Performance Since Inception

The fund has delivered roughly ~29–33% cumulative returns since inception, indicating strong early performance.

Advanced Insights – Risk & Volatility

Tracking Error

As a passive index fund, the tracking error — the deviation from the benchmark index — remains a key metric. Lower tracking error indicates better replication of the index performance. While passive funds generally aim for minimal deviation, real-world transaction costs and liquidity dynamics in smaller stocks may introduce some divergence.

Risk Characteristics

- Sector Concentration: This fund is highly concentrated in financial services. Sectoral concentration increases volatility compared with broad market funds.

- Mid/Small Cap Risk: Mid and small cap stocks traditionally exhibit higher volatility, wider price swings, and sensitivity to economic shifts, making this fund more suitable for long-term investors with strong risk tolerance.

Historical analysis of the underlying index suggests mixed comparative performance versus larger benchmarks like Nifty 400 TRI, underscoring that sector and size biases can cause underperformance in some cycles.

Tax Implications & Investor Considerations

Tax Treatment

- Short-Term Capital Gains (STCG): 15% if units are redeemed within one year.

- Long-Term Capital Gains (LTCG): 10% on gains exceeding ₹1 lakh for holdings beyond one year.

- Dividend Income: Taxed per individual slab and subject to TDS if above thresholds.

Suitable Investor Profile

This fund may suit:

- Long-Term Investors: Those aiming for 5+ year horizons to ride out volatility.

- Risk-Tolerant Profiles: Investors comfortable with sector and market size risk.

- SIP Strategists: Systematic investing can mitigate timing risks in mid/small cap sectors.

Key Advantages & Limitations

Advantages

- Low minimum entry point allows accessibility to retail investors.

- Transparent, rules-based structure without active bias.

- Potential for sector-led outperformance during financial growth cycles.

Limitations

- Sectoral concentration risk amplifies performance swings.

- Higher expense ratio (regular plan) relative to some large-cap index funds.

- Mid/Small cap liquidity constraints can cause tracking and volatility challenges.

Final Takeaway

The Motilal Oswal Nifty MidSmall Financial Services Index Fund represents a compelling thematic index play for investors seeking targeted exposure to India’s evolving financial services landscape. Its passive index replication, low minimum thresholds, and recent performance suggest it can be a valuable component of a diversified long-term equity portfolio, especially for those with a strong conviction in mid and small cap financial sector growth.

However, prospective investors should carefully weigh the risks inherent in sectoral concentration and market size bias, align the investment with their time horizon, and consider SIP strategies to average entry costs over market cycles.

Also Read:

- How Nippon India Multi Cap Fund Delivers Growth: Performance + Insights

- Why HDFC Flexi Cap Fund Is a Top Pick for Diversified Equity Investors

- Multi Cap Funds vs Flexi Cap Funds: Key Differences, Benefits, and Which Is Better for You

People Also Ask

What is Motilal Oswal Nifty MidSmall Financial Services Index Fund?

The Motilal Oswal Nifty MidSmall Financial Services Index Fund is a passive index fund that tracks the Nifty MidSmall Financial Services Total Return Index by investing in mid and small cap financial companies.

How does the Nifty MidSmall Financial Services Index work?

The index includes selected mid and small cap financial services companies and is rebalanced periodically based on predefined eligibility, liquidity, and market capitalization rules.

Is Motilal Oswal Nifty MidSmall Financial Services Index Fund a good investment?

It can be suitable for long-term investors who believe in financial sector growth and can tolerate higher volatility associated with mid and small cap stocks.

What companies are included in the Nifty MidSmall Financial Services Index?

The index includes mid and small cap banks, NBFCs, fintech firms, insurance companies, exchanges, and asset management companies operating in India.

Is this fund actively managed or passive?

This fund is passive and follows a rules-based approach to replicate the performance of its benchmark index without active stock selection.

What is the risk level of this index fund?

The risk level is high due to sector concentration and exposure to mid and small cap stocks, which can be more volatile than large cap equities.

Does this fund invest in mid cap and small cap stocks only?

Primarily yes, although a very small allocation may include large caps if they temporarily qualify under index rules.

What is the minimum investment amount for this fund?

The minimum investment amount is ₹500 for both lump sum and SIP investments, making it accessible to retail investors.

Is SIP allowed in Motilal Oswal Nifty MidSmall Financial Services Index Fund?

Yes, systematic investment plans (SIPs) are allowed and can help investors average costs over market cycles.

How is this fund different from Nifty Financial Services Index Fund?

This fund focuses on mid and small cap financial companies, while the Nifty Financial Services Index mainly consists of large cap financial stocks.

What is the expense ratio of Motilal Oswal Nifty MidSmall Financial Services Index Fund?

The expense ratio is relatively low compared to active funds, with lower costs in the direct plan than the regular plan.

Is this fund suitable for long-term investment?

Yes, it is best suited for investors with a long-term horizon of five years or more to manage volatility effectively.

What are the tax implications of investing in this index fund?

It is taxed as an equity mutual fund, with short-term gains taxed at 15% and long-term gains above ₹1 lakh taxed at 10%.

Does this fund pay dividends?

The fund may offer a dividend option, but dividend payouts are not guaranteed and depend on distributable surplus.

Who should avoid investing in this index fund?

Investors with low risk tolerance, short-term goals, or a preference for diversified equity exposure may consider avoiding this fund.

Feel free to Write for Us about Finance and Follow Us on: Twitter, Facebook, Instagram, Threads, and Whatsapp Group.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any mutual fund units. Mutual fund investments are subject to market risks, including possible loss of principal. Investors should read all scheme-related documents carefully before investing and consider consulting a certified financial advisor to ensure investments align with their risk profile and financial goals. Past performance of the Motilal Oswal Nifty MidSmall Financial Services Index Fund or any other fund does not guarantee future returns.