An in-depth review of Kotak Nifty Financial Services Ex Bank Index Fund explaining how it works, portfolio exposure, risks, returns, and who should invest.

The Kotak Nifty Financial Services Ex Bank Index Fund is an equity index mutual fund from Kotak Mahindra Asset Management Company Limited that aims to replicate the performance of the Nifty Financial Services Ex Bank Total Return Index (TRI).

It offers investors passive exposure to India’s financial services sector excluding banking stocks, focusing on non-bank financial companies such as financiers, insurers, fintech, and capital market firms.

Kotak Nifty Financial Services Ex Bank Index Fund Overview – What It Is and How It Works

Scheme Objective

The fund’s core objective is to replicate the composition and performance of the Nifty Financial Services Ex Bank TRI, subject to tracking errors. It does not seek to outperform the index through active stock selection but to match returns by holding the same securities in proportion to the index.

Launch & Structure

- Launch Date: 14 August 2023.

- Fund Type: Open-ended equity index fund.

- Benchmark: Nifty Financial Services Ex Bank Total Return Index (TRI).

- Plans: Regular and Direct, with Growth and Dividend options.

Minimum Investment

- Lumpsum / SIP: ₹100 minimum for both regular and direct plans.

- Exit Load: None.

Expense Ratio

- Direct Plan: ~0.22%.

- Regular Plan: ~0.73%

The significant difference in expense ratio between Direct and Regular plans highlights the cost advantage of investing directly with the AMC.

➡️What Does “Ex Bank” Mean?

The term “Ex Bank” in the fund’s benchmark index refers to excluding traditional banking stocks (such as private and public sector banks). Instead, the index includes companies primarily engaged in non-bank financial services — such as NBFCs, financial technology firms, insurers, capital market intermediaries, and exchanges.

This allows investors to gain exposure to financial services growth outside the banking segment, which may perform differently than banks depending on economic cycles.

➡️Portfolio Composition & Sector Exposure

The fund closely mirrors the Nifty Financial Services Ex Bank Index composition. The portfolio emphasizes non-bank financial companies across several sectors:

Representative Holdings (Direct Plan example)

- Bajaj Finance Ltd: ~16.17%

- Bajaj Finserv Ltd: ~7.00%

- Shriram Finance Ltd: ~6.99%

- BSE Ltd: ~6.94%

- Jio Financial Services Ltd: ~5.88%

- SBI Life Insurance Company: ~5.17%

- HDFC Life Insurance Company: ~approx. 4–5%

These stocks reflect a mix of NBFCs, fintech, exchanges, and insurance companies — diversifying investors’ exposure across the financial spectrum beyond traditional banks.

Sector Weights (Indicative)

Based on AMC factsheet:

- Finance & Loans: ~56.3%

- Capital Markets: ~19.2%

- Insurance: ~18.0%

- Fintech: ~6.4%

- Net Current Assets: ~–0.06%

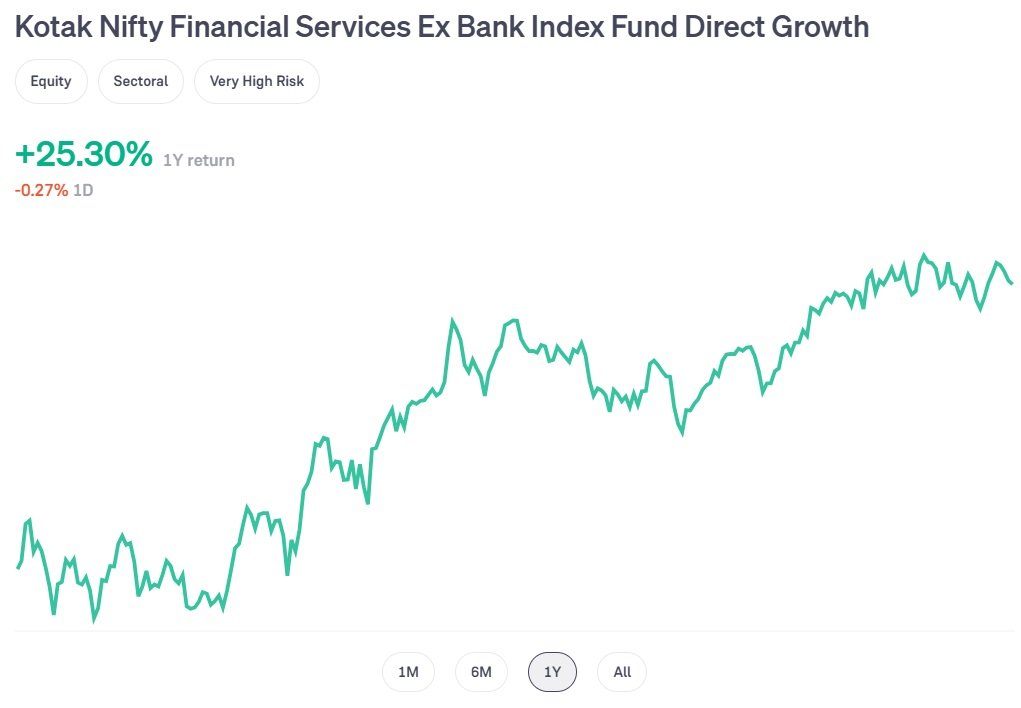

➡️Performance Snapshot (Past Trends)

NAV and Returns

- Direct Growth NAV: Approx. ₹16.33 as of Dec 16, 2025.

- Regular Growth NAV: Approx. ₹16.12 (same date).

Annualized Returns

Since inception (August 2023), the fund’s annualized performance has generally tracked close to its benchmark:

- Direct Plan CAGR: ~22–24% (varies by source).

- Regular Plan CAGR: ~23–25% since inception.

- Benchmark Nifty Financial Services Ex Bank TRI: ~21–25% over similar periods.

These returns reflect an emerging market segment with strong historical growth, though past performance is not a guarantee of future results.

➡️Risk & Volatility Considerations

Tracking Error

As an index fund, tracking error — the difference between fund performance and index returns — is a key metric. Efficient replication depends on low transaction costs, liquidity, and minimal deviation from index weightings.

Sector Concentration

Because the index excludes banks and concentrates on non-bank financial stocks, sector concentration risk is higher than that of broader market funds. These stocks can exhibit higher volatility influenced by credit cycles, interest rate changes, and regulatory developments.

Risk Profile

The fund is generally categorized as medium to high risk, suitable for investors with a longer time horizon (5+ years) and capacity to ride through short-term volatility.

Tax Implications

Tax treatment for equity mutual funds in India applies:

- Short-Term Capital Gains (STCG): 15% if units are sold within one year.

- Long-Term Capital Gains (LTCG): 10% on gains exceeding ₹1 lakh if units are held for over one year.

- Dividend Income: Taxed at investor’s slab; TDS may apply if above thresholds.

➡️Who Is This Fund Best For?

Suitable For

- Investors seeking targeted exposure to non-bank financial services companies.

- Those with medium to long-term investment horizons (5+ years).

- Risk-tolerant investors who can handle sectoral volatility.

Not Ideal For

- Short-term investors (less than 1 year).

- Those who prefer broad market diversification.

- Investors with very low risk tolerance.

➡️Pros & Cons

Advantages

- Exposure to a fast-growing financial services segment outside of traditional banking.

- Low minimum investment, including SIPs from ₹100.

- Historically aligned performance with benchmark.

- Low cost (Direct plan) with minimal management overhead.

Limitations

- Sectoral and concentration risk, less diversified than broader indices.

- Mid-to-high volatility reflects company-specific and economic trends.

- Direct plan requires platform access to reduce costs.

FAQs about Kotak Nifty Financial Services Ex Bank Index Fund

What is Kotak Nifty Financial Services Ex Bank Index Fund?

It is an equity index mutual fund that tracks the Nifty Financial Services Ex Bank Total Return Index, providing passive exposure to non-bank financial services companies.

How is this fund different from a regular financial services index fund?

This fund excludes banks and invests only in other financial services segments like NBFCs, insurers, and fintech stocks.

Can I invest through SIP in this fund?

Yes, systematic investment plans (SIPs) are allowed from as low as ₹100.

Is this fund suitable for long-term goals?

Yes, it is best suited for investors with a long-term horizon due to sector-specific volatility.

What is the expense ratio of this fund?

The direct plan has a lower expense ratio (~0.22%) compared to the regular plan (~0.73%).

Is there an exit load?

No, this fund does not charge an exit load.

Are the returns guaranteed?

No. Returns depend on market performance and index movements; past returns do not guarantee future results.

How is the tax treatment on gains?

STCG is taxed at 15% if sold within a year; LTCG is taxed at 10% beyond ₹1 lakh after one year.

People Also Ask about Kotak Nifty Financial Services Ex Bank Index Fund

What does “Ex Bank” mean in this index fund?

It means the index excludes traditional banking stocks and focuses on other financial services companies.

Is Kotak Nifty Financial Services Ex Bank Index Fund good for SIP?

Yes, it supports SIPs with low minimum amounts, beneficial for systematic investing.

Is this fund actively managed?

No, it is a passive index fund that mirrors its benchmark index.

Can this fund outperform broad market indices?

Sectoral performance can outperform or underperform broad indices depending on market cycles and sector strength.

What are key risks of this fund?

Major risks include sector concentration and high volatility due to non-bank financial stocks.

Is there an advantage to direct plan?

Yes, direct plans have significantly lower expense ratios and can lead to higher net returns.

Does the fund pay dividends?

The dividend option exists, but payouts depend on distributable surplus and are not guaranteed.

What is the benchmark of this fund?

The Nifty Financial Services Ex Bank Total Return Index is the benchmark.

Is Kotak Nifty Financial Services Ex Bank Index Fund good for long-term investment?

Yes, it suits long-term investors who want targeted exposure to non-bank financial services companies.

Does this fund invest in banks?

No, it excludes banking stocks and focuses on NBFCs, insurance, fintech, and capital market firms.

Is this index fund better than active financial sector funds?

It offers lower cost and transparency, but performance depends on sector trends rather than active management.

What is the minimum investment required?

The minimum investment is ₹100 for both lump sum and SIP modes.

Does this fund pay dividends?

A dividend option is available, but payouts are not guaranteed and depend on distributable surplus.

How volatile is this fund?

It can be volatile due to sector concentration and sensitivity to interest rates and economic cycles.

Is the direct plan better than the regular plan?

Yes, the direct plan has a lower expense ratio, which can result in higher net returns over time.

Can beginners invest in this fund?

Beginners can invest if they understand sectoral risks and have a long-term investment horizon.

Conclusion

The Kotak Nifty Financial Services Ex Bank Index Fund is a thematic passive index fund that offers targeted exposure to India’s financial services sector beyond traditional banks. With low minimum investment requirements and a cost-efficient direct plan, it suits investors seeking sector-specific exposure with a medium-to-long-term horizon.

However, sector concentration and volatility mean it is best used as a complementary holding within a diversified equity portfolio rather than as a core investment. Thorough understanding of sector dynamics and personal risk tolerance is essential before investing.

Also Read:

- Motilal Oswal Nifty MidSmall Financial Services Index Fund – Detailed Analysis and Facts

- How Nippon India Multi Cap Fund Delivers Growth: Performance + Insights

- Why HDFC Flexi Cap Fund Is a Top Pick for Diversified Equity Investors

Feel free to Write for Us about Finance and Follow Us on: Twitter, Facebook, Instagram, Threads, and Whatsapp Group.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any mutual fund units. Mutual fund investments are subject to market risks, including possible loss of principal. Investors should read all scheme-related documents carefully before investing and consider consulting a certified financial advisor to ensure investments align with their risk profile and financial goals. Past performance of the Kotak Nifty Financial Services Ex Bank Index Fund or any other fund does not guarantee future returns.